Lynnwood Property Taxes . Web to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Start by choosing which type of bill to search: Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew concerns from councilmembers and. From the dollar bill graphic below, you will see that 6 cents. Web while the assessor sets the value for taxable property, the taxing district’s budgets and voter approved measures determine your. Or house number* street name* * do not put the house number in the street name field and avoid using directionals. Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office.

from www.pdffiller.com

Web to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Web while the assessor sets the value for taxable property, the taxing district’s budgets and voter approved measures determine your. Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Start by choosing which type of bill to search: Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew concerns from councilmembers and. From the dollar bill graphic below, you will see that 6 cents. Or house number* street name* * do not put the house number in the street name field and avoid using directionals.

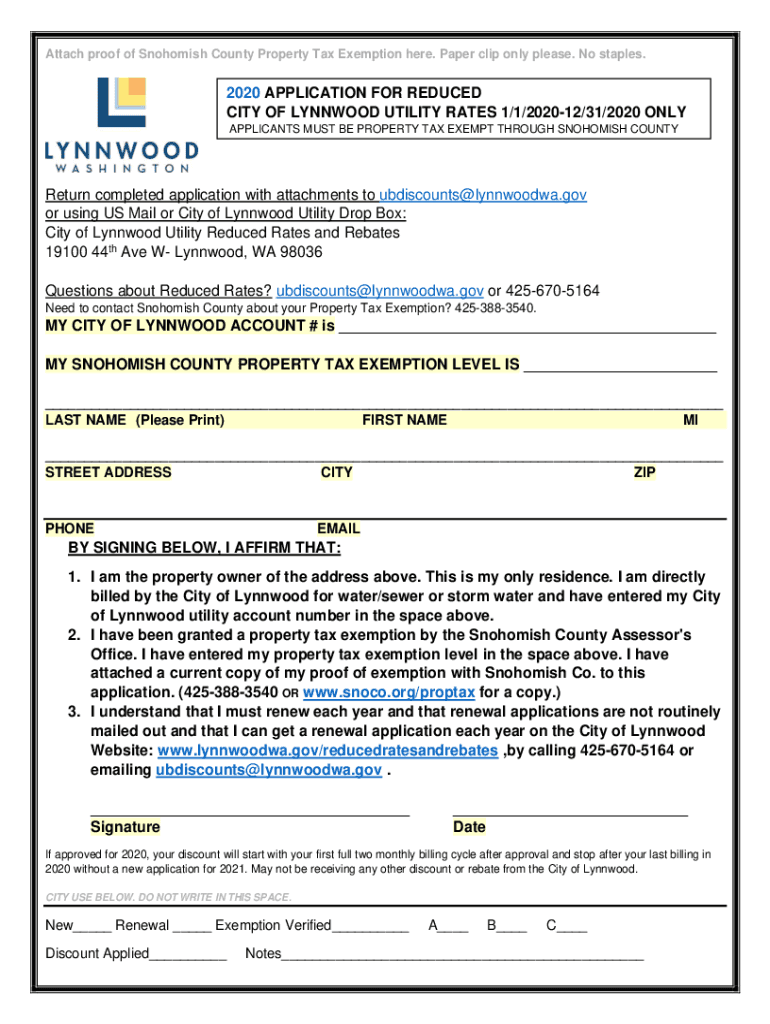

Fillable Online Property Tax Exemption Reduced Rates Application

Lynnwood Property Taxes Or house number* street name* * do not put the house number in the street name field and avoid using directionals. From the dollar bill graphic below, you will see that 6 cents. Or house number* street name* * do not put the house number in the street name field and avoid using directionals. Web to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew concerns from councilmembers and. Start by choosing which type of bill to search: Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Web while the assessor sets the value for taxable property, the taxing district’s budgets and voter approved measures determine your. Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av).

From lynnwoodtimes.com

With 3 million surplus, residents argue against 22 property tax Lynnwood Property Taxes Web while the assessor sets the value for taxable property, the taxing district’s budgets and voter approved measures determine your. Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew concerns from councilmembers and. Accounts with delinquent taxes. Lynnwood Property Taxes.

From lynnwoodtimes.com

Snohomish County residents are to beware of phony tax debt scam Lynnwood Property Taxes Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew concerns from councilmembers and. Or house number* street name* * do not put the house number in the street name field and avoid using directionals. Web while the assessor sets the value. Lynnwood Property Taxes.

From www.pinterest.com

Property Tax Exemptions Snohomish County, WA Official Website Lynnwood Property Taxes Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Web to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. From the dollar bill graphic below, you will see that 6 cents. Start by choosing which type of bill to. Lynnwood Property Taxes.

From lynnwoodtimes.com

With 3 million surplus, residents argue against 22 property tax Lynnwood Property Taxes Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Web to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. From the dollar bill graphic below, you will see that 6 cents. Web a proposal to increase city of lynnwood. Lynnwood Property Taxes.

From lynnwoodtimes.com

City Council passes budget modifications and property tax levy Lynnwood Property Taxes Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew concerns from councilmembers and. Start by choosing which type of bill to search: Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Or. Lynnwood Property Taxes.

From lynnwoodtimes.com

Individual property tax deadline extended to June 1 Lynnwood Times Lynnwood Property Taxes Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Or house number* street name* * do not put the house number in the street name field and avoid using directionals. Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). Web a proposal to increase city of. Lynnwood Property Taxes.

From lynnwoodtoday.com

Council votes to decrease property tax levy, postpones discussions of Lynnwood Property Taxes Or house number* street name* * do not put the house number in the street name field and avoid using directionals. Web while the assessor sets the value for taxable property, the taxing district’s budgets and voter approved measures determine your. Start by choosing which type of bill to search: Accounts with delinquent taxes must first be approved by the. Lynnwood Property Taxes.

From lynnwoodtoday.com

Inflation has turned Washington state’s property tax cap into a county Lynnwood Property Taxes Web while the assessor sets the value for taxable property, the taxing district’s budgets and voter approved measures determine your. Or house number* street name* * do not put the house number in the street name field and avoid using directionals. Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Web to calculate the exact. Lynnwood Property Taxes.

From minervajohansen.blogspot.com

snohomish property tax rate Minerva Johansen Lynnwood Property Taxes Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew concerns from councilmembers and. Start by choosing which type of bill to search: Web while the assessor sets the value for taxable property, the taxing district’s budgets and. Lynnwood Property Taxes.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Lynnwood Property Taxes Or house number* street name* * do not put the house number in the street name field and avoid using directionals. Start by choosing which type of bill to search: Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Web to calculate the exact amount of property tax you will owe requires your property's assessed. Lynnwood Property Taxes.

From xrebellious-wiishes.blogspot.com

snohomish property tax payment Mario Head Lynnwood Property Taxes From the dollar bill graphic below, you will see that 6 cents. Web while the assessor sets the value for taxable property, the taxing district’s budgets and voter approved measures determine your. Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew. Lynnwood Property Taxes.

From www.lynnwoodwa.gov

Treasury City of Lynnwood Lynnwood Property Taxes Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). Start by choosing which type of bill to search: Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew concerns from councilmembers and. Web to calculate the exact amount of property tax you will owe requires your property's. Lynnwood Property Taxes.

From lynnwoodtoday.com

Council discusses city's 202324 budget, 2023 property tax levy before Lynnwood Property Taxes Start by choosing which type of bill to search: Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office. Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew concerns from councilmembers and. Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). From. Lynnwood Property Taxes.

From lynnwoodtimes.com

Lynnwood to hold Public Hearing on 2024 property tax levy increase of Lynnwood Property Taxes Or house number* street name* * do not put the house number in the street name field and avoid using directionals. Web a proposal to increase city of lynnwood 2024 property taxes by 22.3% drew concerns from councilmembers and. From the dollar bill graphic below, you will see that 6 cents. Web to calculate the exact amount of property tax. Lynnwood Property Taxes.

From www.redfin.com

1911 201st Pl SW, Lynnwood, WA 98036 MLS 2125694 Redfin Lynnwood Property Taxes From the dollar bill graphic below, you will see that 6 cents. Web to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). Web while the assessor. Lynnwood Property Taxes.

From www.heraldnet.com

A 32.5 hike in home values, but property taxes increases will vary Lynnwood Property Taxes Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). Start by choosing which type of bill to search: Web while the assessor sets the value for taxable property, the taxing district’s budgets and voter approved measures determine your. Web a proposal to increase city of lynnwood 2024 property taxes by 22.3%. Lynnwood Property Taxes.

From lynnwoodtimes.com

Vote to take place on November 27 for 22 property tax increase for Lynnwood Property Taxes Web while the assessor sets the value for taxable property, the taxing district’s budgets and voter approved measures determine your. Web to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Accounts with delinquent taxes must first be approved by the snohomish county treasurer’s office.. Lynnwood Property Taxes.

From lynnwoodtimes.com

Mukilteo City Council discusses Property Tax Levies and Lodging Tax Lynnwood Property Taxes Web while the assessor sets the value for taxable property, the taxing district’s budgets and voter approved measures determine your. Web the 2024 city of lynnwood property tax levy rate is $0.53 per $1,000 of assessed value (av). From the dollar bill graphic below, you will see that 6 cents. Or house number* street name* * do not put the. Lynnwood Property Taxes.